As calendar year 2025 draws to a close, market veteran Nilesh Shah struck a reflective and unusually mathematical note on social media platform X, reminding followers that some years leave behind more than just market memories and return charts.

Shah’s post point out why 2025 stands apart—not for returns, volatility or macro cycles, but for its rare numerical elegance.

“We have experienced many calendar years in our life and will experience many more. But, I think that no year can match mathematical wonder of 2025,” he said in an X post.

Over decades of experience in investing, Shah has often emphasised long-term thinking, patience and perspective—traits that resonate even more strongly as one calendar year ends and another begins. His post tapped into that sentiment, suggesting that while years come and go, some carry a quiet uniqueness that deserves acknowledgment.

2025 = Mathematical Wonder

In his post, Shah highlighted that 2025 is not just another number on the calendar, but a mathematical curiosity. To begin with, 2025 is itself a perfect square, as 45 multiplied by 45 equals 2025. That alone makes it rare, but the elegance does not stop there.

He further pointed out that 2025 is also the product of two squares—9 squared multiplied by 5 squared—further reinforcing its symmetry. Adding to the intrigue, the number can be expressed as the sum of three squares, with 40 squared, 20 squared and 5 squared together arriving precisely at 2025.

Perhaps the most striking observation in Shah’s post was that 2025 is also the sum of the cubes of all single-digit numbers from 1 to 9. When each of these digits is cubed and added together, the result once again lands exactly at 2025—a coincidence that feels almost poetic in its completeness. This report is based on user-generated content from social media. Livemint has not independently verified the claims and does not endorse them.

Market 2026 Outlook

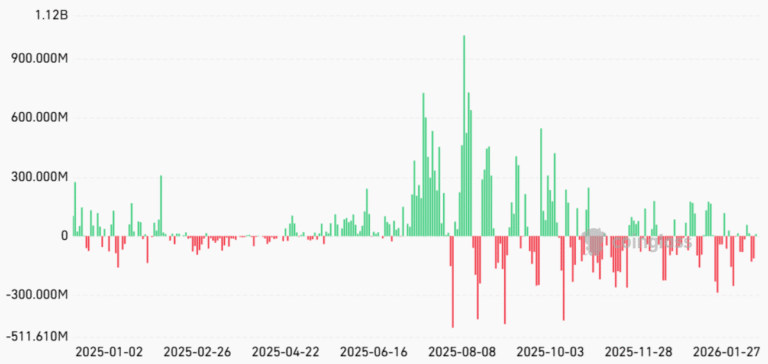

After a volatile 2025, Indian stock market investors should prepare for a more moderate phase ahead, according to Nilesh Shah. While returns are expected to stay positive in 2026, he said expectations need recalibration after the exceptional performance of recent years.

In Kotak Mutual Fund’s annual market outlook for 2026, Shah noted that fiscal policy is increasingly driving global growth as monetary support gradually recedes. Although rate cuts are underway, the conditions that powered earlier market rallies have weakened. “Global growth will remain positive but may slow down a little in CY26 over CY25,” he said.

Shah flagged key risks including inflation, technological disruption, de-dollarisation, the AI debate and US–China rivalry. He added that while headline indices are near record highs, many stocks remain well below their peaks. Although large-cap earnings have been weak over the past six quarters, Shah expects an improvement ahead.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.