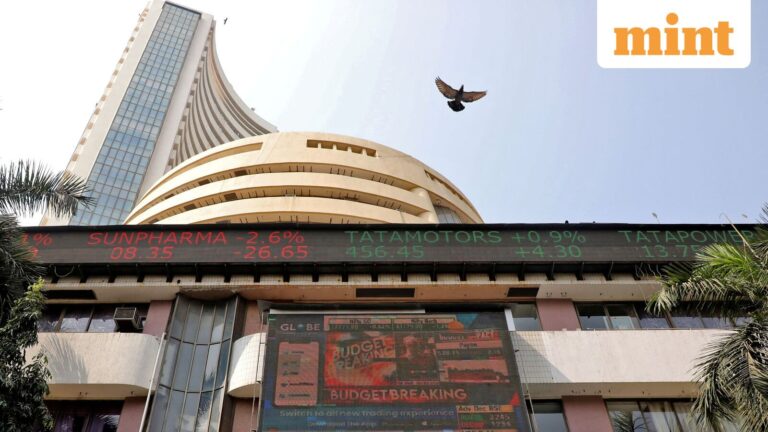

The Indian stock market recorded losses for the third consecutive day on Wednesday, January 21, although the declines were limited due to a sharp recovery in the latter half of the session.

Following heavy losses in the US market, both the Nifty 50 and Sensex opened lower, and the sell-off intensified during the first half, with both indices losing over 1% at their intraday lows before recovering partial losses.

Consequently, the Nifty closed down 0.3% at 25,157 points, while the Sensex ended the session at 81,909, down 0.33% from the previous close. The broader markets, however, underperformed the key indices, with the Nifty Midcap 100 falling 1.15% and the Nifty Smallcap 100 losing 0.9%.

All major sectoral indices closed in the red, with Nifty Chemicals facing the largest fall of 2.13%, followed by Nifty Consumer Durables and Nifty PSU Bank, each down by 1.66% and 1%, respectively. Other sectors, including Nifty Realty, Nifty FMCG, Nifty Pharma, Nifty Media, Nifty IT, and Nifty Auto, fell between 0.3% and 0.71%.

Concerns have mounted that tariff threats by US President Donald Trump on European countries linked to Greenland could escalate into a full-scale global trade war, triggering panic selling across major global markets and reviving memories of the sharp sell-off seen when Trump announced “liberation tariffs” in April last year.

Apart from unsupportive global cues, the domestic macro picture appeared gloomy. The first batch of December-quarter results from Nifty 50 companies was muted, with bottom-line performance impacted by labour code–related expenses.

This also appeared to weigh on foreign portfolio investors’ sentiment, as they offloaded another ₹2,938 crore during Tuesday’s session, taking month-to-date outflows to ₹29,135 crore, according to NSDL data.

Persistent selling by FPIs also weighed on the Indian rupee, which touched another record low of 91.7 against the US dollar.

Mid- and small-cap sell-off deepens amid risk-off sentiment

Kalyan Jewellers led the list of top laggards, with the stock plunging 12.2% to ₹396 apiece, marking its lowest level since 2024. Today’s sharp fall also resulted in nine consecutive sessions of decline and a cumulative loss of 24%.

SRF shares tumbled 7.2% to a nine-month low of ₹2,676, as investors were disappointed by the company’s indication that it may miss its earlier FY26 specialty chemicals sales growth guidance, despite reporting a healthy performance for the December quarter.

Tata Communications shares also came under pressure following the release of its Q3 numbers, dropping 5.5% to ₹1,617 apiece. Another Tata Group stock, Tata Chemicals, slipped 5.1% to ₹693 apiece.

Extending losses to a third straight session, Paytm shares cracked another 4.7% to ₹1,235, their lowest level in over two months.

Capital market–related stocks such as Nuvama Wealth Management, Angel One, Motilal Oswal Financial Services, UTI Asset Management, and 360 One WAM declined between 3% and 4%.

Other major laggards included Cyient, Force Motors, Laurus Labs, CEAT, UPL, JK Cement, L&T Finance, Amber Enterprises, Netweb Technologies, Alok Industries, RHI Magnesita India, Waaree Energies, PG Electroplast, Inox Wind, and Premier Energies, with most stocks falling in the range of 3% to 5%.

Q3 earnings cheer lifts select stocks

Mangalore Refinery and Petrochemicals, CreditAccess Grameen, and IndiaMART Intermesh were among the top gainers in the Nifty 500 pack, rising 9.2%, 9.1%, and 5.7%, respectively, as investors reacted positively to the companies’ December-quarter numbers.

KPR Mill also saw its shares climb 6% to ₹859, snapping a three-day losing streak, while Eternal shares closed 5% higher at ₹283.5 apiece.

Meanwhile, the record-breaking rally in copper prices continued to support Hindustan Copper, with the stock ending the session 5% higher at ₹557 apiece.

Other top gainers, including ITC Hotels, Welspun Living, Jindal SAW, City Union Bank, Chennai Petroleum, IDBI Bank, and Radico Khaitan, all closed the day with gains of over 3%.

Disclaimer: We advise investors to check with certified experts before making any investment decisions.