Both contracts reclaimed February’s central pivots after Tuesday’s full rotation, with the market now pressing into decision zones where acceptance or rejection will shape the post-Minutes response.

ES and Dow trading desk — Feb 18, 2026

Mid-London – New York: CP reclaimed ahead of the Fed Minutes

ES trading desk — Feb 18, 2026

Mid-London – New York: CP reclaimed ahead of the Fed Minutes

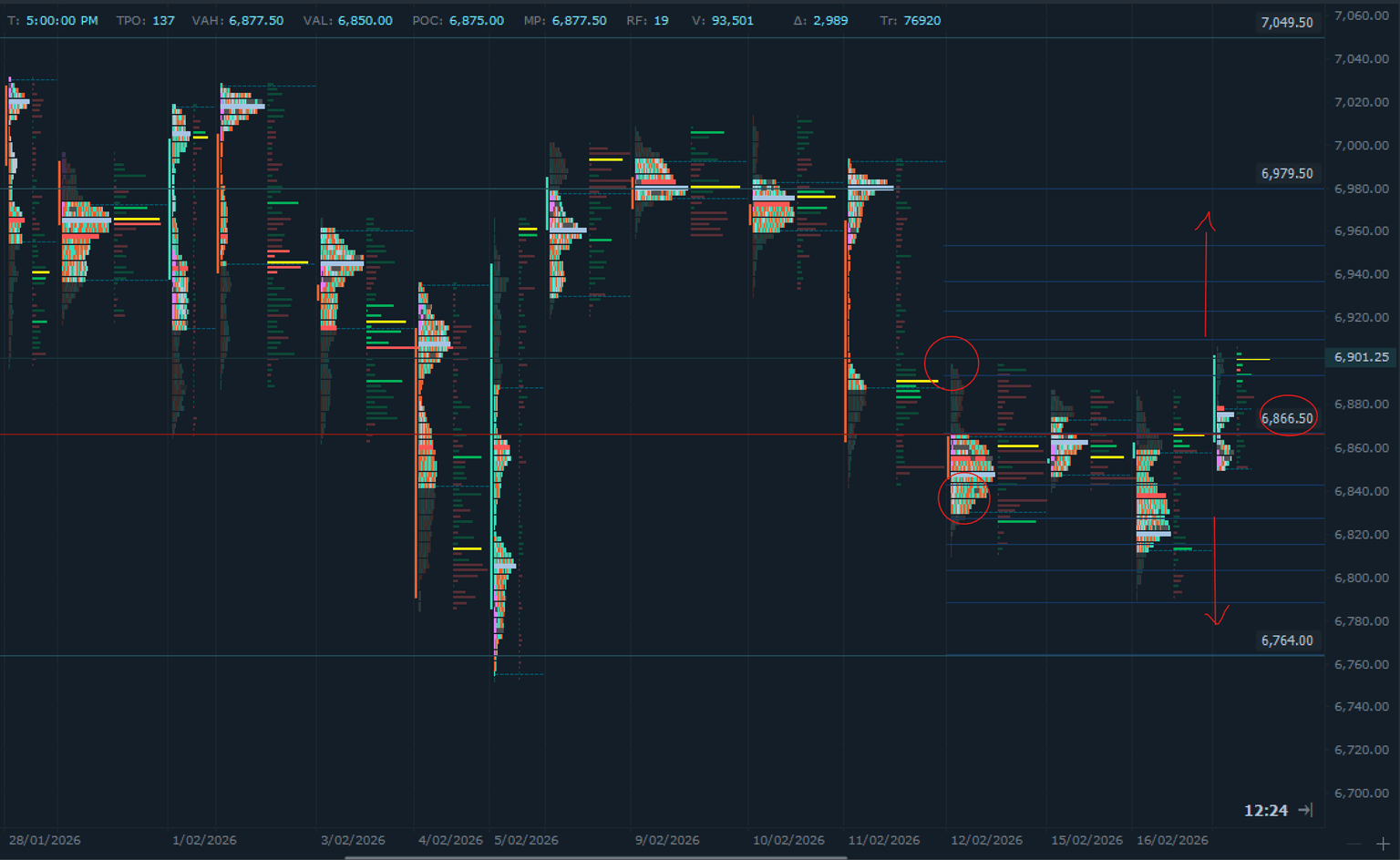

Tuesday delivered a full rotation, but the bigger picture remains the same: February is still a two-way structure. The key development into today is CP 6866.50 reclaimed, putting the market back in the upper-half rotation.

As of this update, ES is trading around 6896, sitting at the upper gate 6893–6909. This zone decides whether we transition into the upper range or rotate back into balance.

Today’s decision tree:

As long as ES holds above 6866.50 CP, the focus stays on whether 6893–6909 accepts into the upper range; failure back below CP puts 6842–6827 back in play.

ES key levels (structure first)

Decision points

- Upper gate: 6893–6909.

- CP: 6866.50.

- Lower gate: 6842–6827.

Upside progress (if accepted above the upper gate)

Downside progress (if CP fails / lower gate breaks)

ES scenarios into New York

1) Break + hold above 6909 (acceptance)

Acceptance above the gate opens 6923 / 6936 / 6952. Best tell is pullbacks into 6909–6893 getting defended and price not snapping back into the middle.

2) Rejection at 6893–6909 (rotation back into balance)

A gate rejection typically rotates back to 6866.50 CP. If CP holds, two-way trade stays active.

3) Lose CP (lower side rotation resumes)

Below 6866.50, the next test is 6842–6827.

- Hold the lower gate = rotation conditions persist.

- Lose the lower gate = opens 6815 / 6803 / 6788.

Acceptance checklist (quick tells)

- Holds outside the gate across multiple rotations (not one spike)

- Pullbacks are defended at the gate/CP

- Value starts building on the new side (no instant snap-back)

Execution note: Don’t force trades in the middle. One-way moves usually start after acceptance outside the gates — inside the gates is two-way business.

Fed Minutes note: Expect a knee-jerk reaction first. The cleaner read is where price stabilises 10–20 minutes after the release.

Dow Futures (YM) trading desk — Feb 18, 2026

Mid-London – New York: CP reclaimed ahead of the Fed Minutes

YM mirrored ES after Tuesday’s full rotation: price tagged 49,239, then rotated back higher and reclaimed CP 49,555, returning above the higher-volume area. The February map remains a two-way structure, with today’s focus on whether the upper gate can convert from resistance into acceptance.

As of the Mid-London update, YM is trading around 49,854, right on the upper gate 49,719–49,821.

Today’s decision tree:

As long as YM holds above 49,555 CP, the focus stays on whether 49,719–49,821 accepts; rejection rotates back to CP, and a CP loss brings 49,406–49,314 into view.

YM key levels (structure first)

Decision points

- Upper gate: 49,719–49,821.

- CP: 49,555.

- Lower gate: 49,406–49,314.

Upside progress (if accepted above the upper gate)

- 49,903 – 49,986 – 50,087 – 50,252.

Downside progress (if CP fails / lower gate breaks)

- 49,239 – 49,164 – 49,072.

YM scenarios into New York

1) Break + hold above 49,821 (acceptance into upper range)

Acceptance above the gate opens 49,903 / 49,986 / 50,087, with 50,252 as the bigger upside target if momentum sustains.

2) Rejection at 49,719–49,821 (rotation back to CP)

If the gate rejects, rotation back to 49,555 CP is the base case. If CP holds, the two-way structure stays in play.

3) Lose CP (lower side rotation)

Below 49,555, focus shifts to 49,406–49,314.

- Hold the lower gate = rotation and possible bounce back to CP.

- Lose the lower gate = opens 49,239 / 49,164 / 49,072.

Acceptance checklist (quick tells)

- Holds outside the gate across multiple rotations

- Pullbacks are defended at the gate/CP

- Value builds on the accepted side

Execution note: Don’t trade the middle. Wait for acceptance/rejection at the gates, or trade clean rotations back to CP.

Fed Minutes note: The first move can be a trap. Watch where price settles 10–20 minutes after the release.

ES – YM alignment check

If both contracts are accepting above their upper gates, the upside scenario has better odds. If one accepts and the other rejects, expect more chop and failed breakouts.

Conclusion: What the market is telling us into the Minutes

Right now, both ES and YM are holding above their central pivots, and the behaviour is similar: Tuesday’s rotation was absorbed, buyers reclaimed the decision points, and price is now pressing into the upper gates. That’s the market saying one thing clearly — risk is being held higher into the event, and any upside attempt will be judged by acceptance above the gates, not by the first spike.

Still, the true picture only comes after the Minutes hit. Often, the market positions ahead of the news, and the post-release flow simply confirms what was already building. Other times, that positioning is wrong and unwinds quickly. That’s why the edge isn’t in predicting the headline — it’s in knowing the current status (above CP, at the gate, or below it) and having the what-if scenarios ready before the volatility arrives.

Key focus after the release:

- If the price is accepted above the upper gates, the upper-range targets come into play.

- If price rejects and rotates back to CP, two-way conditions remain active.

- If price loses CP, the lower gates become the next decision points, and downside progress can accelerate.

These desk updates document a structure-first process, observing how price accepts or rejects predefined levels over time. Coverage spans futures, commodities, forex, bonds, crypto, stocks, and indices, with structure providing context before direction. This observation is for informational purposes only and does not constitute financial advice.

Structure defines context; price reveals response.