Here are Thursday's biggest analyst calls: Nvidia, Dell, Chewy, Verizon, DoorDash, Carvana, Palantir & more

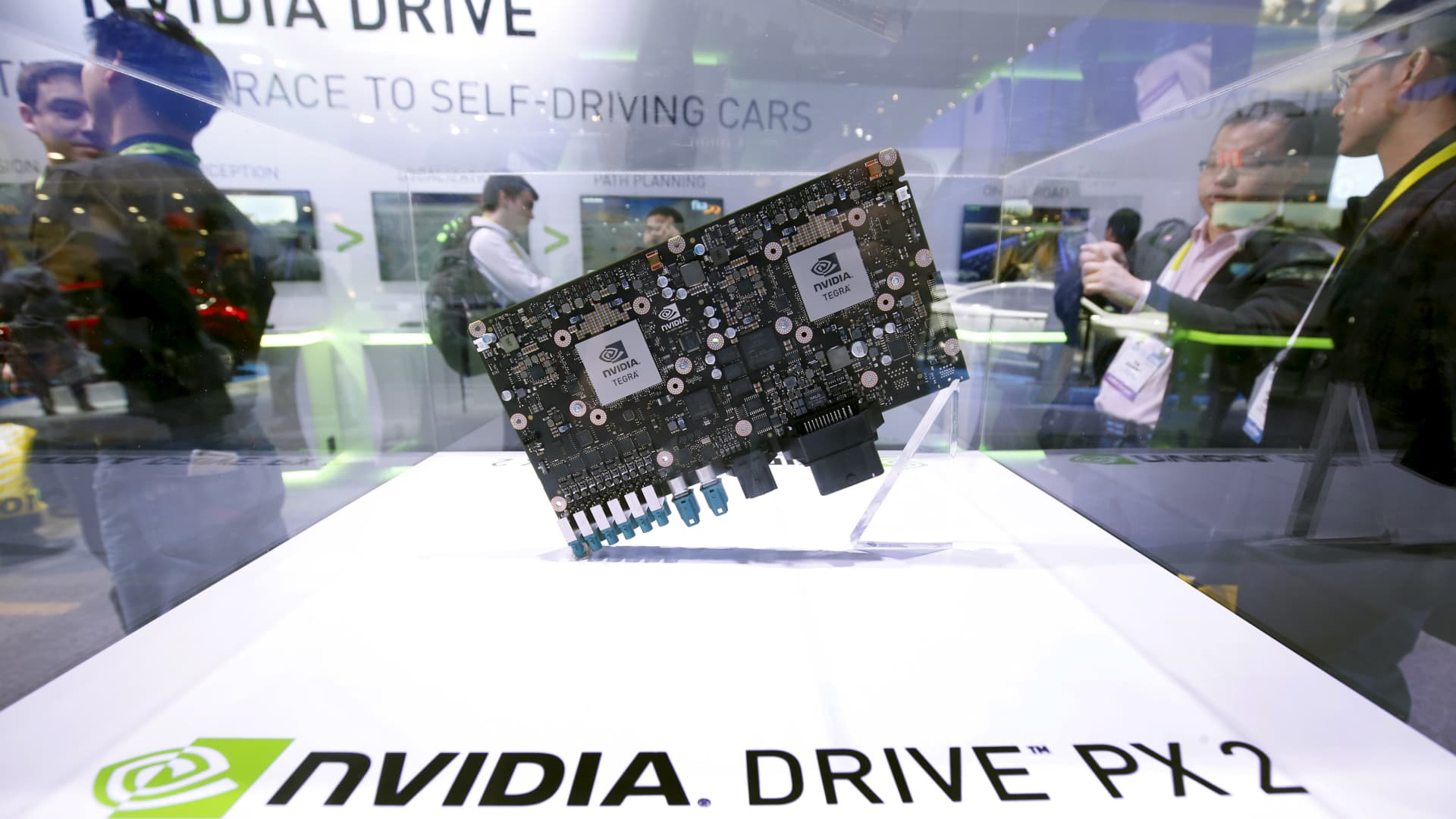

Here are the biggest calls on Wall Street on Thursday: Oppenheimer reiterates Nvidia as outperform Oppenheimer says it’s bullish on Nvidia shares ahead of earnings next week. “We see several structural tailwinds driving sustained out-sized top-line growth in high performance gaming, datacenter/AI and autonomous driving vehicles.” Barclays upgrades CIBC to overweight from underweight Barclays says the Canadian bank has plenty of upside. “Over the past two years, CM has demonstrated progress towards its medium-term targets supported by ROE expansion, more consistent earnings performance, positive operating leverage, benign credit quality and higher capital deployment through share repurchases.” Goldman Sachs initiates Credo Technology at buy Goldman says it sees a “favorable” risk/reward for the connectivity company. “We initiate coverage of CRDO with a Buy rating and a 12-month price target of $165.” Read more. Evercore ISI adds a tactical outperform on Dell Evercore says it’s bullish ahead of earnings next week but did lower its price target to $160 per share from $180. “We expect DELL to print upside to current rev/EPS expectations of $31.4B/3.52 given strong NT demand trends across traditional hardware and AI compute. With concerns around memory inflation, expect DELL to have benefited from a demand pull-in across PCs and traditional servers as customers will have looked to get ahead of ASP [average selling price] increases.” Raymond James upgrades Chewy to outperform from market perform The investment bank says the online pet company stock is too attractive to ignore. “We upgrade CHWY to Outperform from Market Perform following recent weakness, which creates attractive risk/reward with EV/EBITDA ~8x on 2027E. We like the setup of a low bar coupled with topline and margin opportunities in 2026.” Read more. Mizuho initiates Tempus AI at outperform Mizuho says shares of the AI healthcare company have plenty more room to run. “We initiate coverage of Tempus AI, Inc., with an Outperform rating and $100 price target.” Read more. RBC initiates Rhythm Pharmaceuticals at outperform RBC says the biotech company is well positioned for growth and in the obesity space.” “We Think RYTM Is Set’ Up to Hit High Notes in Rare Obesity.” Mizuho upgrades LeonaBio to outperform from neutral Mizuho said in its upgrade of the biotech company that it sees a compelling risk/reward for LeonaBio. “With meaningful data expected in 2027, we see an attractive risk/reward, particularly for the longer-term oriented investor.” KeyBanc raises Symbotic to overweight from sector weight KeyBanc says it’s getting more constructive on the industrial automation stock after a series of investor meetings. “We hosted investor meetings with SYM’ s CFO Izzy Martins and VP Investor Relations Charlie Anderson in NYC and Boston. Following our meetings, we are upgrading to OW from SW with a $70 PT.” Bank of America removes Palantir from US1 list Bank of America removed the data analysis stock from its top ideas list but said it’s sticking with its buy rating. “We are removing Palantir Technologies Inc. (PLTR) from the US 1 List. PLTR remains Buy-rated.” Bank of America reiterates Carvana as buy Bank of America lowered its price target to $400 per share from $460 following earnings but says Carvana remains a share gainer. “The company remains in growth mode, with best-in-class eCommerce growth driven by market expansion and greater penetration in existing markets.” Wells Fargo initiates AxoGen at overweight Wells says the biotech company is best positioned for growth. “Our Overweight rating on AXGN reflects the company’s differentiated nerve repair platform, Avance, and its growth opportunity in the multi-billion dollar peripheral nerve repair TAM.” Needham upgrades Analog Devices to buy from hold Needham says it sees “additional room to run” for the stock. ADI reported strong F1Q26 results and provided F2Q26 guidance meaningfully above expectations. As operating results continue to improve, we can no longer justify remaining on the sidelines.” Bank of America upgrades Dentsply Sirona to buy from neutral The investment bank says shares of the dental equipment company are too attractive to ignore at current levels. “We think the risk/reward for XRAY finally skews positive, and we frame several variables ahead of the 2026 guide next week, which could be a clearing event.” Deutsche Bank reiterates DoorDash as buy Deutsche says DoorDash’s earnings report on Wednesday was a “clearing event.” “Most positively, with grocery and retail unit economics and international contribution profit turning positive in the 2H, the margin cadence for 2026 should improve dramatically as we move through the year offsetting growth investments that should scale later in 2026.” Daiwa upgrades Verizon to buy from outperform and T-Mobile to outperform from neutral Daiwa says it’s bullish on both cellular companies. “Given low valuation and w/ best risk/reward, we upgrade VZ to 1/Buy. … TMUS have recently been raising rates on legacy plans, which supports our view that the industry is showing price rationality.”