Aditya Birla Fashion and Retail shares tanked 9% during Tuesday’s trading session amid a likely block deal in the counter.

According to a CNBC-TV18 report, approximately 4.35 crore shares, representing 3.57% of the company’s total equity, changed hands today. The shares were traded at an average price of ₹66.4 each, resulting in a total deal value of ₹289 crore, the business news channel said, citing sources.

In the case of Aditya Birla Lifestyle Brands, 2.8% of the company’s total equity was transacted in a large trade, the report added.

The identities of the buyers and sellers involved in the transaction remain undisclosed. Mint was not able to verify the details immediately. Information about block deals is released on the exchanges after the market closes.

On Monday, January 19, CNBC-TV18 noted that block deals were anticipated to take place involving two firms from the Aditya Birla Group. It remains uncertain who is intending to sell their stake in these transactions.

The report added that an institutional investor plans to divest up to 3% of its equity in Aditya Birla Lifestyle Brands Ltd. through a block deal valued at $43 million. The floor price for the transaction has been set at ₹106.14 per share, according to sources from the report. This transaction is anticipated to be a clean-out trade, as per the information provided by sources to CNBC-TV18.

By the end of the September quarter, one of the promoter groups, Pilani Investment and Industries, owned 3.67% of the company, while SBI Life Insurance Co. Ltd. held a 2.25% stake in the company, according to the report.

In Aditya Birla Fashion and Retail Ltd, an unnamed institutional investor was expected to sell a portion of up to 3% of its stake through a block deal for $32 million at a floor price of ₹65.78 per share, according to sources mentioned in the news report. This deal is also described as a clean-out trade, said CNBC-TV18, citing sources.

Aditya Birla Fashion share price today

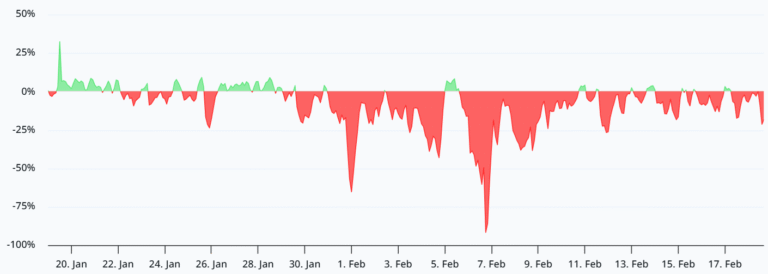

Aditya Birla Fashion share price today opened at ₹68.06 apiece on the BSE. The stock touched an intraday high of ₹68.18 apiece and an intraday low of ₹65.81 per share.

According to Anshul Jain, Head of Research at Lakshmishree, Aditya Birla Capital Limited has tested its key monthly swing low near 66.38, a level that historically attracts demand. “The stock is now significantly stretched away from its 50-week moving average, creating a classic mean reversion setup. This extension increases the probability of a technical bounce rather than immediate continuation lower,” said Jain.

A bounce back toward the 73 to 78 resistance band looks highly likely as short covering and tactical buying emerge, he said, adding that the structure remains fragile and this move should be viewed as corrective. “A decisive close below 65 would invalidate the bounce thesis, break long-term support, and reopen deeper downside risk. Until then, risk–reward favours a tactical rebound rather than fresh shorts,” added the technical analyst.

Disclaimer: The views and recommendations above are those of individual analysts, experts and broking companies, not of Mint. We advise investors to check with certified experts before making any investment decision.