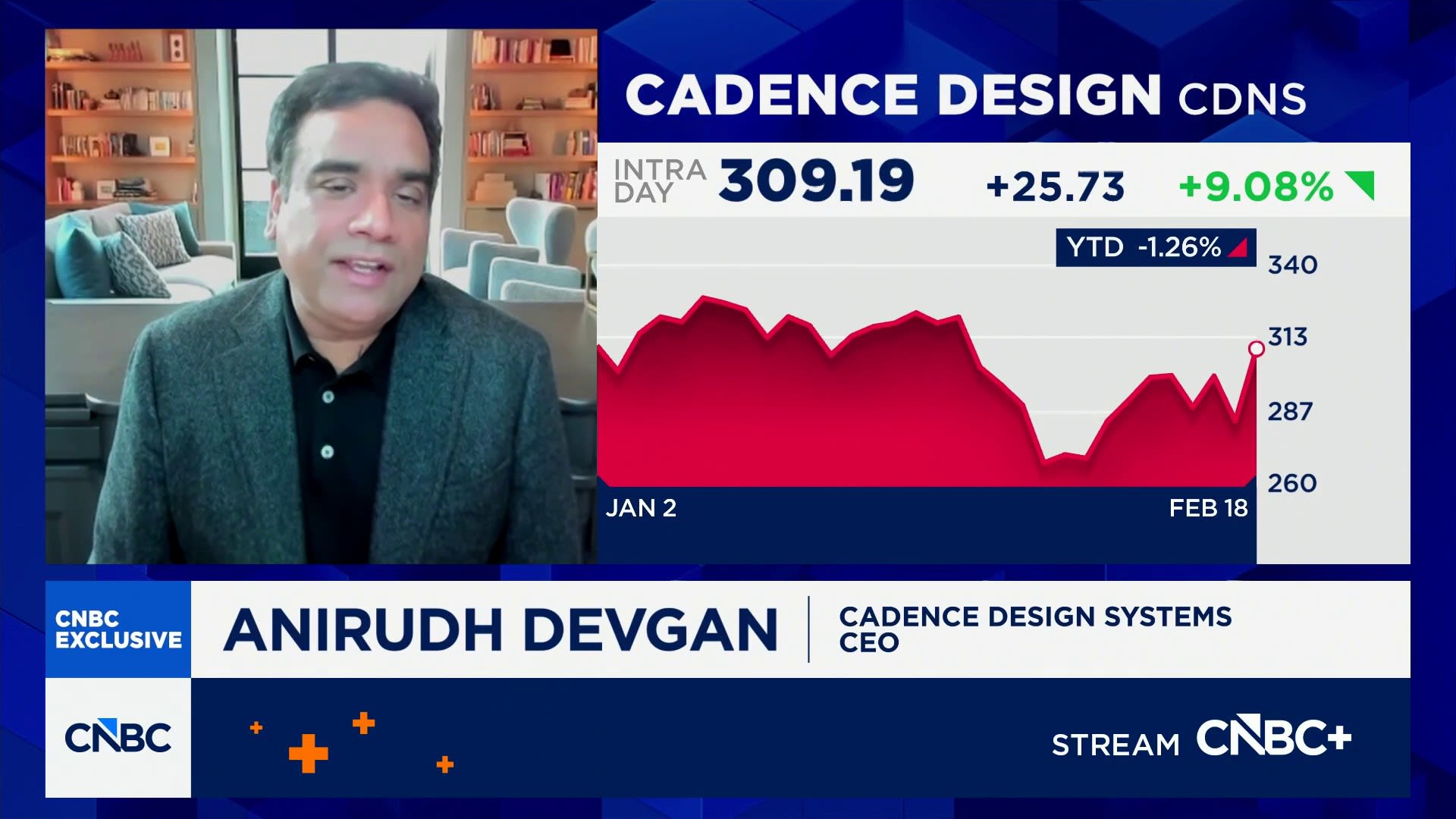

Cadence Design Systems stock rose 9% on Wednesday after the chip design software company reported earnings that beat analysts’ expectations.

The San Jose-based company reported financials after the bell Tuesday, posting an adjusted earnings per share of $1.99 on revenue of $1.44 billion in the fourth-quarter of 2025, about 6% higher versus the prior year on both measures.

Analysts surveyed by LSEG were expecting an EPS of $1.91 and revenue of $1.42 billion.

CEO Anirudh Devgan told CNBC’s “Squawk on the Street” on Wednesday that about 45% of its business is now coming from what he called “system companies,” which include hyperscalers and end producers of phones and cars.

“System companies want to optimize the hardware and software stack together, and one way to do that is the critical component, is designing their own chips that are optimized to their workload,” Devgan said.

Cadence Design Systems has been riding a wave of artificial intelligence-related capital expenditures and research and development efforts by a range of tech enterprises working to create large language models and infuse them into their internal and customer-facing apps and products.

Devgan pointed to Apple‘s efforts with their own smartphone chips, and Google‘s custom AI silicon as leading examples, and said the trend of system companies doing their own chips “is only going to accelerate,” he said.

The company said it expects $5.9 billion to $6 billion in revenue for the next fiscal year, at the top end of FactSet’s $5.94 billion expectation.

Cadence competes with other companies that sell chip design software, including Synopsys and Siemens.