Fairchem Organics, engaged in the manufacturing of specialty chemicals, said in a regulatory filing today that its board of directors has approved a proposal to buy back fully paid-up equity shares of face value ₹10 each of the company.

Fairchem Organic Buy Back details

Number of Securities Proposed for the Buyback: The company proposes to buy back up to 4,25,000 equity shares, representing up to 3.26% of the total number of equity shares in the existing total paid-up equity share capital of the company (on a standalone basis).

Buyback Price: The company has set the buyback price at ₹800 per equity share, payable in cash, for an amount aggregating up to ₹34 crore.

The price indicates a 15% premium to the stock’s latest closing price of ₹697 apiece.

Record Date: The record date has not been fixed by the company. “The public announcement and other documents in relation to the buyback, setting out the process, record date, timelines, and other requisite details, will also be released in due course in accordance with the SEBI Buyback Regulations,” the company said in its filing.

Buyback Size Capped at 16%: The company’s proposed buyback, including transaction costs, is capped at 16% of the aggregate of its total paid-up equity share capital and free reserves, based on the latest audited financial statements as of March 31, 2025.

This limit ensures that the buyback remains within the regulatory framework while accounting for all associated expenses, such as legal, advisory, and brokerage fees.

Pre- and Post-Buyback Shareholding Pattern: The company’s promoters currently own 79,67,823 shares, representing a 61.19% stake in the company, which is likely to increase post-buyback to 83,92,823 shares, or 64.45% of the company’s equity.

As per the BSE shareholding pattern, FI Mauritius Investments Limited held the majority stake of 52.83% in the company as of the September quarter-end. FIIs own 6.2% of the shares, DIIs hold 5.8%, while the remaining 26.9% is owned by the general public shareholders.

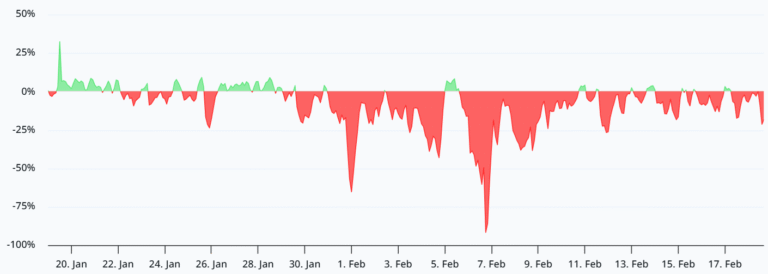

Fairchem Organics Share Price Trend

The company’s shares have remained under prolonged pressure, which is still ongoing, resulting in a 71.53% decline from its record high of ₹2,449, touched in October 2022. The stock has closed in the red for the last five months, including November, and has slipped to its lowest level since May 2021, dropping to ₹697 apiece.

Disclaimer: This story is for educational purposes only. The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.