Gold price today: Gold rate jumped by more than 1% in early trade on the MCX on Friday, February 13, on value buying after significant losses in the previous session.

MCX gold April contracts jumped by ₹2,000, or 1.30%, to ₹1,54,837 per 10 grams. MCX silver March futures rose by over ₹5,600, or 2.4%, to ₹2,42,081 per kg.

International gold prices also witnessed buying as US gold futures for April delivery gained 0.7% to $4,985.40 per ounce. Spot silver rose 2.1% to $76.76 per ounce, after a 11% drop on Wednesday, according to Reuters.

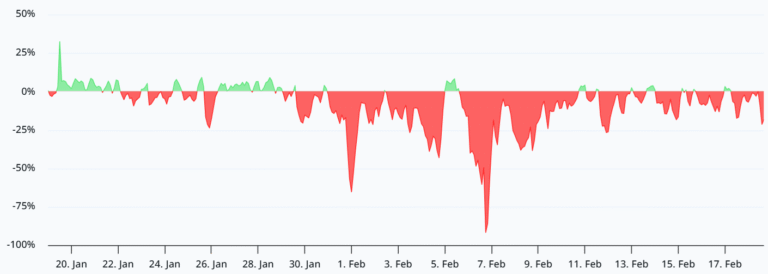

“Gold rose to around $4,960 per troy ounce after falling more than 3% in the previous session, as markets navigated elevated volatility. Thursday’s drop occurred during a broad market selloff that led investors to liquidate precious metals to raise cash,” Jigar Trivedi, Senior Research Analyst at IndusInd Securities, noted.

“Stronger-than-expected January jobs data released earlier this week have led markets to price in a first rate cut in July rather than June,” Trivedi added.

US data, quoted by Reuters on Wednesday, showed that the nonfarm payrolls rose by 1,30,000 jobs in January, after a downwardly revised 48,000 increase in December, while the unemployment rate declined to 4.3%.On Thursday, weekly data showed initial jobless claims fell to 2,27,000 in the week ended February 7.

Strong jobs data has dented expectations of a US Fed rate cut. Investors now await inflation data due later on Friday for more cues on the Fed’s interest rate trajectory.

Trivedi expects MCX gold April futures to rebound to ₹1,54,000 per 10 grams as prices have recovered slightly in the world markets too.

For MCX silver, Trivedi believes prices may advance to ₹2,42,000 per kg amid a short covering in the world markets.

Aksha Kamboj, Vice President at the India Bullion and Jewellers Association (IBJA) and Executive Chairperson of Aspect Global Ventures, noted that gold is witnessing pullbacks from recent highs as profit-taking begins despite a positive overall sentiment.

Although the price is trading erratically, Kamboj believes there is a strong chance the precious metal is on the verge of a long bull run, driven by uncertainty and rising policy trends.

Read all market-related news here

Read more stories by Nishant Kumar

Disclaimer: This story is for educational purposes only. The views and recommendations expressed are those of individual analysts or broking firms, not Mint. We advise investors to consult with certified experts before making any investment decisions, as market conditions can change rapidly and circumstances may vary.