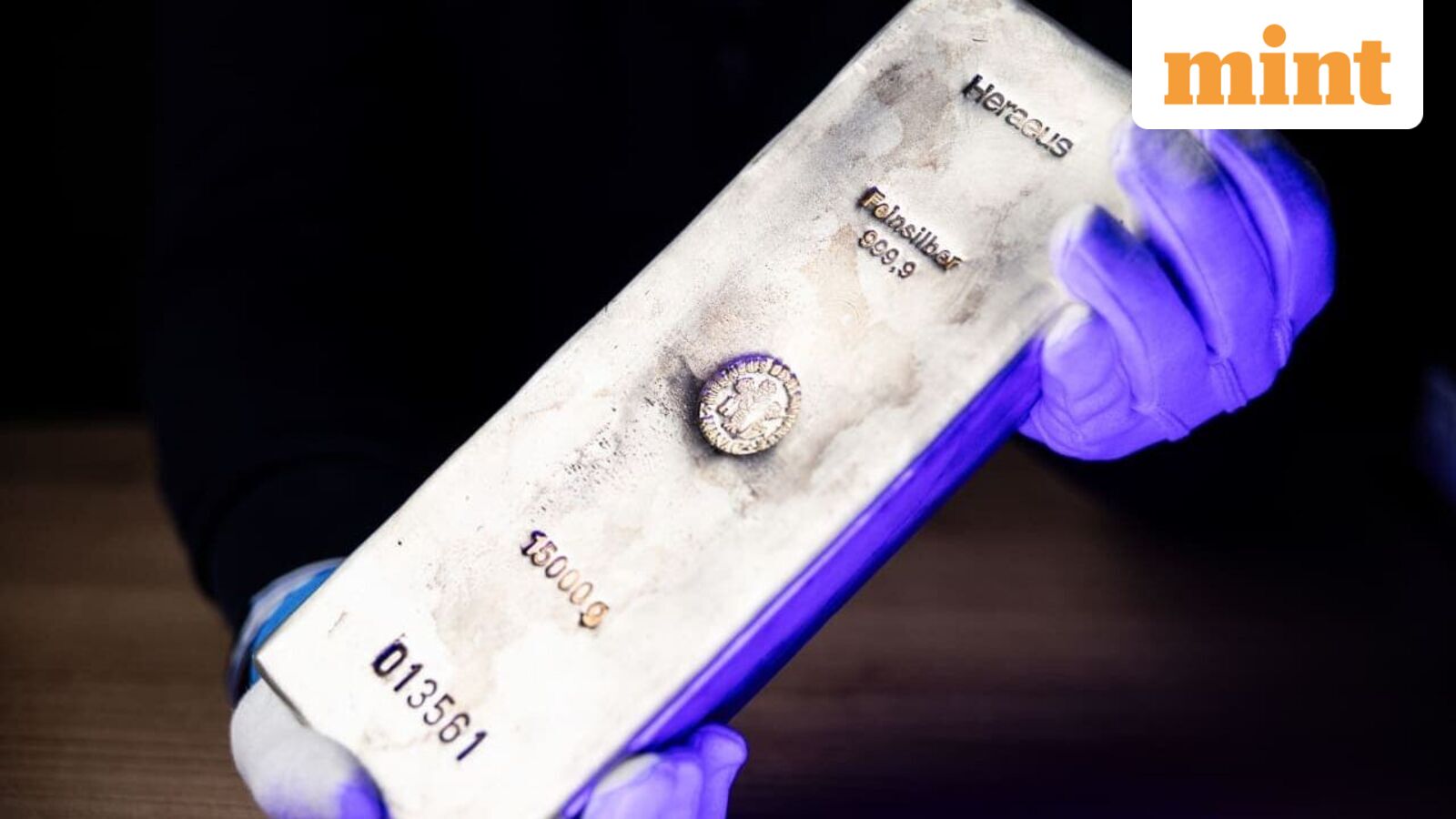

Silver price today: Silver prices crashed on Friday, January 30 hitting its 15% lower circuit as a firmer US dollar weighed on sentiment, even as the metal remained on course for a historic month.

On MCX, Silver price shed ₹59,983 to hit its lower circuit of ₹3,39,910 after hitting a record high of ₹4,20,048/kg in the previous session (January 29). It is now down 19% or over ₹80,000 from its record high.

Globally, Spot silver slipped 0.2% to $115.83 an ounce after touching a fresh all-time high of $121.64 on Thursday. The white metal has surged about 62% so far this month, putting it on track for its strongest monthly performance on record.

The pause in the rally today came after the dollar index climbed nearly 0.50% after US President Donald Trump and Democrats reached an agreement late Thursday to avoid a partial government shutdown. The US Federal Reserve’s decision to maintain a status quo on interest rates further supported the dollar, adding pressure on metal prices.

Fed Chair Jerome Powell said inflation in December was likely still above the central bank’s 2% target. Data showed weekly US jobless claims fell, signalling limited layoffs, even as subdued hiring kept labour market sentiment cautious. Moreover, geopolitical tensions also stayed elevated amid reports that US President Donald Trump is weighing options against Iran.

Gold prices also retreated, with spot gold down 0.9% at $5,346.42 an ounce by 0124 GMT, after hitting a record $5,594.82 a day earlier. Gold has climbed over 24% in January, marking its biggest monthly rise since 1980, while US gold futures rose 1.3% to $5,390.80.

Among other metals, spot platinum fell 0.9% to $2,606.15 after a recent peak, while palladium gained 0.5% to $2,016.69.

Opportunity to buy?

Rajkumar Subramanian, Head – Product & Family Office at PL Wealth, highlighted the sharp rally in silver over the past year, noting that domestic prices have surged from around ₹1.5–1.6 lakh per kg in early 2025 to above ₹4 lakh per kg by late January 2026. This translates into gains of nearly 165–170% over the last 12 months, with prices hitting fresh record levels above ₹4 lakh per kg on January 29, 2026.

He attributed the rise to a combination of safe-haven demand, tight supply conditions and structurally rising industrial usage across sectors such as solar, electronics and manufacturing, which aligns closely with India’s growth trajectory. At the same time, he cautioned that silver carries higher risk, noting that “silver remains a volatile metal, with historical annualised volatility often in the 25–35% range, higher than gold.” Given the sharp run-up, he advised investors to consider staggered allocations instead of lump-sum investments to manage near-term correction risks while staying invested in silver’s long-term structural drivers.

Technical Target

From a technical perspective, Renisha Chainani, Head of Research at Augmont, said silver prices can consolidate here in the range of $108 to 120 before resuming its uptrend towards $125–130 ( ₹4,30,000–4,50,000). Key support lies at $108 ( ₹3,60,000), below which prices may retrace to $103–$98.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.