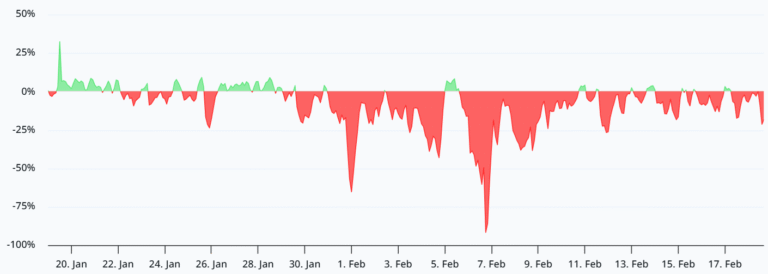

Stocks to buy for the short term: A Sharp selloff in IT stocks roiled Indian stock market sentiment, as equity benchmark Nifty 50 ended 0.57% lower at 25,807.20 on Thursday, February 12.

There was a broad-based selloff amid mixed global cues as strong US jobs data dented expectations of US Fed rate cuts in the next policy meeting.

“Sentiment weakened as traders reacted to heavy selling in information technology stocks and mixed global developments. Strong U.S. jobs data reduced expectations of imminent Federal Reserve rate cuts, which weighed on global risk assets and contributed to the domestic market’s downturn,” Ajit Mishra, SVP of Research at Religare Broking.

“Multiple intraday rebound attempts failed to sustain. Although most domestic and global factors remain broadly supportive, the sharp correction in the IT pack has temporarily put bulls on the back foot,” said Mishra.

Mishra believes the downside may remain limited due to strength in other key sectors, and the Nifty may hold the 25,600–25,700 zone, while 26,000 will continue to act as a key hurdle.

In the current environment of volatility and mixed cues, Mishra advises participants to maintain a selective, stock-specific approach and follow strict risk management until the index resumes its uptrend.

Stock picks for the short term

Bharat Electronics (BEL) | Last traded price (LTP): ₹443.90 | Buy | Target price: ₹475 | Stop loss: ₹428

Mishra highlighted that BEL stands out within the defence space as an outperformer, maintaining strength even at elevated price levels.

After consolidating for more than a year, the stock has delivered a decisive breakout,

indicating the formation of a trend-continuation pattern that often signals the start of the next upward leg.

“Following the breakout, BEL is trading near its neckline, aligned with the 20-day EMA, where it has developed a buying pivot—suggesting renewed momentum. Given this constructive technical structure, BEL can be considered for trading opportunities,” said Mishra.

Glenmark Pharmaceuticals | LTP: ₹2,034.50 | Buy | Target price: ₹2,200 | Stop loss: ₹1,950

Mishra pointed out that Glenmark has consistently held above its long-term moving average (200-day EMA) and its previous breakout zone near the ₹1,800 mark for a prolonged period, reflecting strong underlying support.

The measured decline has taken the form of a structured base, which could potentially evolve into a bullish continuation pattern.

“Currently, the stock has given a range breakout near the key short-term averages, indicating the possibility of renewed upward momentum. Considering the sustained stability in price action and the favourable risk-reward setup, long positions may be considered in the stock,” said Mishra.

Max Financial Services | LTP: ₹1,813.50 | Buy | Target price: ₹1,940 | Stop loss: ₹1,750

Mishra believes Max Financial remains firmly positioned in a bullish trajectory, characterised by a sustained sequence of higher highs and higher lows, which validates the strength of the ongoing uptrend.

“It has developed successive base formations and has now broken out from an elevated consolidation zone, reinforcing the strength in the positive trend,” said Mishra.

“With price trading near record highs and constructive price and volume action, the setup favours continuation of the uptrend. Hence, long positions can be considered within the specified range,” Mishra said.

Read all market-related news here

Read more stories by Nishant Kumar

Disclaimer: This story is for educational purposes only. The views and recommendations expressed are those of the expert, not Mint. We advise investors to consult with certified experts before making any investment decisions, as market conditions can change rapidly and circumstances may vary.