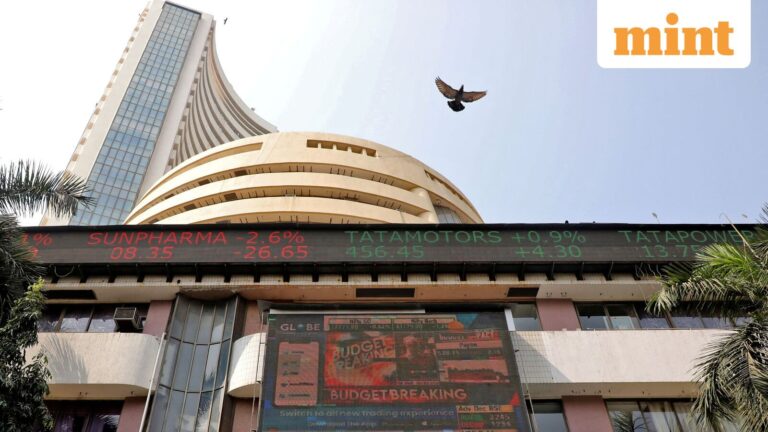

Indian stock market: The Indian stock market witnessed sharp declines on Friday, February 13, weighed down by weak global cues and rising concerns about artificial intelligence and its potential impact on the global economy.

The Sensex plunged 1,048 points, or 1.25%, to close at 82,626.76, while the Nifty 50 fell 336 points, or 1.30%, to settle at 25,471.10.

Stock market next week

Nifty 50

According to Sumeet Bagadia, Executive Director at Choice Broking, the Nifty 50 opened the session with a steep gap-down of more than 200 points and stayed under selling pressure for most of the day.

During the first half, the index attempted to hold above the 25,500 mark, but the buying support failed to sustain. In the second half, selling intensified further, pushing the index to an intraday low of 25,444 before it settled at 25,471, indicating a weak close and the absence of a meaningful recovery. The overall intraday pattern clearly shows consistent selling at higher levels and limited buying interest, reflecting a cautious and defensive market sentiment, he said.

“On the technical front, resistance is positioned in the 25,600–25,650 zone, while the key support area is seen between 25,300 and 25,350. The daily RSI reading of 46 signals neutral to slightly negative momentum, suggesting a lack of strong bullish strength. At the same time, India VIX jumped 13.37% to 13.29, highlighting rising volatility and growing uncertainty in market conditions. In the derivatives space, significant put writing at 25,300 and heavy call writing at 25,600 indicate a likely range-bound movement. Traders are advised to stay cautious around crucial support levels and wait for a clear breakout above resistance before taking fresh directional trades,” Bagadia added.

Bank Nifty

Bank Nifty opened on a negative note, slipping over 180 points at the start, and remained in a bearish trajectory throughout the session.

On the Bank Nifty outlook, Bagadia further opined that continuous selling pressure dragged the index to a day’s low of 60,073, and it finally closed at 60,186.65, registering a loss of 553 points for the day, indicating a weak close and strong intraday selling dominance. This price action reflects sustained supply pressure at higher levels and a lack of meaningful buying support during the session.

“Technically, immediate resistance is seen in the 60,500–60,600 zone, while the 59,850–59,950 range remains a crucial support area for near-term stability. On the daily chart, the RSI at 53.83 signals positive momentum with a healthy bullish bias, suggesting underlying strength despite the ongoing consolidation phase. Traders should exercise caution around major support levels and avoid taking fresh directional trades until a clear and decisive breakout above resistance is confirmed,” he said.

Stocks to buy

Sumeet Bagadia has recommended three stocks to buy on Monday, February 16. The three stock picks by Bagadia are – Aditya Birla Fashion and Retail, IFCI, and South Indian Bank.

1] Aditya Birla Fashion and Retail: Buy at ₹73.8 | Target Price: ₹79.5 | Stop Loss: ₹71.5

2] IFCI: Buy at ₹62.87 | Target Price: ₹68 | Stop Loss: ₹60

3] South Indian Bank: Buy at ₹40.95 | Target Price: ₹44 | Stop Loss: ₹39.5

Disclaimer: This story is for educational purposes only. The views and recommendations above are those of individual analysts or broking companies, not Mint. We advise investors to check with certified experts before making any investment decisions.