Stocks to watch today: Indian equity benchmark indices, the Sensex and the Nifty 50, are likely to open on a weak note on Friday, tracking a broad sell-off across global markets. Asian equities moved lower, while US stocks ended in the red overnight as technology shares came under pressure amid renewed concerns over artificial intelligence-led disruption.

On Thursday, domestic markets closed lower due to profit booking across sectors, with IT stocks bearing the brunt of the selling pressure. The Sensex dropped 558.72 points, or 0.66%, to settle at 83,674.92, while the Nifty 50 declined 146.65 points, or 0.57%, to close at 25,807.20.

Asian markets remained mostly subdued on Friday, following overnight losses on Wall Street. Japan’s Nikkei 225 slipped 1.69%, while the broader Topix index fell 0.58%. South Korea’s Kospi declined 0.48%, and the Kosdaq dropped a sharper 1.36%. Hong Kong’s Hang Seng index futures also pointed to a lower opening. US equity markets ended lower on Thursday, weighed down by continued selling in technology stocks, as investors stayed cautious ahead of key US inflation data.

Meanwhile, geopolitical developments were also in focus after a Bloomberg report said the Kremlin has outlined proposals that could see Russia embrace the dollar again as part of a broader economic partnership with the Trump administration, citing an internal Russian document.

Stocks to Watch today

Coal India: Coal India, which accounts for about 80% of domestic coal output, reported consolidated net profit of ₹8,505.57 crore in the year-ago period. Sales declined to ₹30,818.17 crore from ₹32,358.98 crore YoY, while consolidated expenses rose to ₹28,132 crore from ₹27,280 crore. The board declared a third interim dividend of ₹5.50 per equity share for FY26.

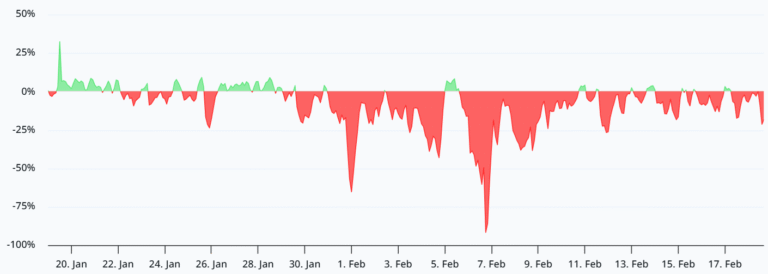

Indian IT stocks: Indian IT ADRs fell sharply on the NYSE. Infosys ADRs plunged 10% to $14.21, while Wipro ADRs dropped 5%. Global software and tech stocks weakened as investors fear AI disruption could upend the traditional outsourcing-led IT services business model.

Indian Hotels Company: Indian Hotels reported a 50.86% YoY jump in consolidated net profit to ₹954.24 crore for the quarter ended December 31, 2025, compared with ₹632.53 crore in the year-ago period, supported by steady demand across its hospitality portfolio.

Hindustan Unilever: HUL reported a 30% YoY decline in consolidated net profit from continuing operations to ₹2,118 crore versus ₹3,027 crore. However, reported consolidated net profit more than doubled to ₹6,603 crore, aided by a one-time gain from the ice cream business demerger. PBT before exceptional items stood at ₹3,495 crore.

Hindalco Industries: Hindalco posted a 45% YoY fall in Q3 net profit to ₹2,049 crore, compared with ₹3,735 crore, missing Bloomberg estimates of ₹4,141 crore. Revenue from operations rose 13.9% YoY to ₹66,521 crore, slightly above street estimates of ₹64,581 crore.

Honasa Consumer: Honasa Consumer nearly doubled Q3 net profit to ₹50 crore from ₹26 crore YoY. Revenue rose 16% to ₹602 crore, while expenses increased 8%. The company said a ₹28 crore revenue impact from a Flipkart settlement change had no effect on profitability.

Bharat Forge: Bharat Forge reported a 28% YoY rise in consolidated net profit to ₹272.80 crore, with revenue up 24.9% to ₹4,342.93 crore. Standalone profit fell 17% YoY to ₹288.1 crore, impacted by labour code provisions and higher tariffs, while revenue slipped 0.6% to ₹2,083.7 crore.

ONGC: ONGC’s consolidated net profit rose 22.6% YoY to ₹11,946 crore in Q3 FY26, while revenue from operations remained flat at ₹1.67 trillion. The board declared a second interim dividend of ₹6.25 per share, implying a total payout of ₹7,863 crore, with February 18, 2026 as the record date.

IRCTC: IRCTC reported a 15.6% YoY increase in Q3 net profit to ₹394.3 crore from ₹341 crore. Revenue grew 18.4% YoY to ₹1,449.4 crore, driven by growth across catering, tourism and ticketing segments.

Lupin: Lupin posted consolidated net profit of ₹1,175.6 crore in Q3 FY26, up 37.5% YoY, though lower sequentially. Revenue rose 24.3% YoY to ₹7,167.5 crore. Exceptional items included ₹449.4 crore for antitrust litigation and ₹134.8 crore toward an Astellas settlement.

Biocon: Biocon reported net profit of ₹143.8 crore in Q3 FY26, sharply higher than ₹25.1 crore YoY, aided by a low base. Revenue grew 9.2% YoY to ₹4,173 crore but missed estimates of ₹4,556.2 crore. The quarter included a one-time exceptional loss of ₹293.4 crore.