Zaggle Prepaid share price slumped nearly 40% from its 52-week high recently. Zaggle Prepaid share price today rose by 3% following a partnership with Truecaller International LLP. Recently, Bajaj Broking began coverage on the fintech stock with a ‘Buy’ rating, predicting a 30% upside and establishing a target price of ₹456.

As stated by the brokerage, Zaggle is rapidly growing by pursuing strategic acquisitions and developing new product categories, including the acquisition of a 26% interest in a UPI switch provider, with intentions to raise its stake to 42%.

The company is branching out into fleet management (Zatix) and international payment solutions. It is also considering mergers and acquisitions to enhance its range of products. These efforts reinforce Zaggle’s status as an emerging leader in the fintech sector.

Moreover, the brokerage firm indicated that Zaggle is strategically placed within India’s fast-expanding fintech industry, bolstered by strong collaborations with banks, a variety of revenue sources, and an ambitious growth plan. The organisation aims for a revenue increase of 58-63%, fueled by higher corporate adoption, and seeks to reach a 15-16% EBITDA margin over the next four years, highlighting its commitment to profitability.

“Zaggle presents a compelling investment opportunity. Based on a FY27 PE multiple of 31x and an estimated FY27 EPS of ₹14.72, we initiate a BUY call on the stock with a target price of ₹456,” said Bajaj Broking in its report.

Here’s what technical analysts say about the Fintech stock

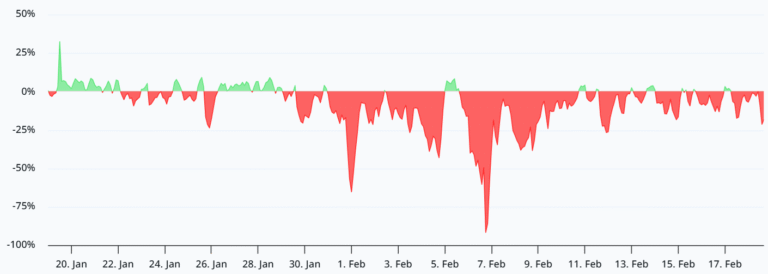

Rajesh Bhosale, Equity Technical and Derivative Analyst at Angel One, explained that since February, Zaggle Prepaid share prices are trading in a range ₹320 and ₹380 forming a channel pattern , next directional move would be seen only on a range breakout beyond the same, above 380 expect the upmove to extend towards ₹425 whereas a break below ₹320 could drag prices back towards ₹285.

Further, Anshul Jain, Head of Research at Lakshmishree Investment and Securities stated that after a buying climax at 590, Zaggle Prepaid share price corrected 46.45% in just 10 weeks and has been forming a base for the last six weeks within a rectangle pattern between ₹376-315. A breakout or breakdown from this range will dictate the next move.

“However, with falling 10, 20, and 50 EMAs, the rectangle is more likely a continuation pattern, increasing the chances of a breakdown below ₹315. If this level is breached and sustained, a further downside move is expected. Traders should watch for volume expansion to confirm the direction of the breakout,” added Jain.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.